This guide, including the FAQs below, was developed to assist you in choosing the right health insurance in Texas for you and your family.

The coverage options found in Texas’s ACA Marketplace may be a good choice for many consumers. Texas uses the federally run health insurance exchange (Marketplace), HealthCare.gov, for residents to purchase its ACA Marketplace plans.

The Marketplace provides access to health insurance products from numerous private insurers (coverage areas vary from one insurer to another; most areas of the state have plans available from multiple insurers, but there are some counties in north-central Texas where only a single insurer offers Marketplace coverage). 1

Depending on your income and other circumstances, you may qualify for financial assistance through the Marketplace which can reduce your monthly insurance premium (the amount you pay to enroll in the coverage) and possibly your out-of-pocket expenses.

Texas implemented a new rule — for coverage effective in 2023 and future years — requiring health insurers to add a 35% load to the cost of silver plans to account for CSR. 2 This effectively makes silver plan prices higher than most gold plan prices, resulting in larger subsidies and even more affordable premiums for bronze and gold plans. 3

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Texas.

Learn about Texas's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Texas as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Texas.

To qualify for health coverage through the Texas Marketplace, you must:

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your income. In addition, to qualify for financial assistance with the cost of your Marketplace plan you must:

In Texas, you can sign up for an ACA-compliant individual or family health plan from November 1 to January 15 during open enrollment. 6

If you need your coverage to start on January 1, you must apply by December 15. If you apply between December 16 and January 15, your coverage will begin on February 1. 7

Outside of open enrollment, a special enrollment period (typically linked to a specific qualifying life event) is necessary to enroll or make changes to your coverage.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

To enroll in an ACA Marketplace plan in Texas, you can:

You can also call HealthCare.gov’s contact center by dialing 1-800-318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, seven days a week, but it’s closed on holidays.

Texas uses the federally run exchange for individual market plans, so residents who buy their own health insurance enroll through HealthCare.gov.

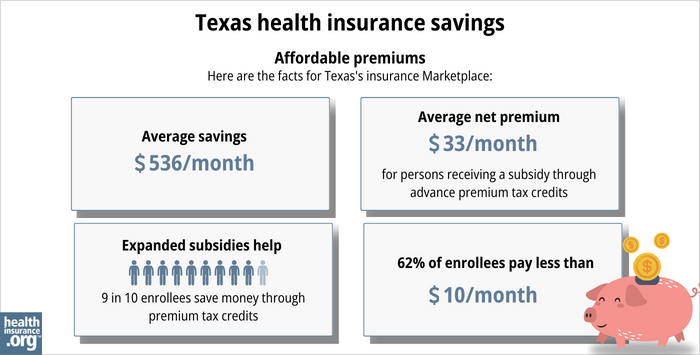

Across the nearly 2.4 million Texas residents who had effectuated Marketplace coverage in early 2024, 97% were receiving advance premium tax credits (premium subsidies) that paid an average of $533/month toward their premium costs. Across all enrollees, this reduced the average net premium to about $51/month. 9

(The numbers above are based on effectuated enrollment as of early 2024, whereas the graphic below shows data from enrollments submitted during the open enrollment period that began in the fall of 2023, so the numbers differ and there are different metrics reported.)

In addition to premium subsidies, the Affordable Care Act also includes cost-sharing reductions (CSR), which help to reduce out-of-pocket costs on Silver-level plans for people with household income up to 250% of the poverty level. 11

Between the premium subsidies and cost-sharing reductions, you may find that an ACA plan is the cheapest health insurance option for you.

And as noted above, Texas requires health plans to charge higher premiums for Silver-level plans 2 (to account for the loss of federal CSR funding, but in a uniform manner).

The result is that it’s common to see Gold plans priced lower than Silver plans. If you’re not eligible for CSR, this can make a Gold plan a particularly good value in Texas. 3 (If you are eligible for CSR, you’ll want to carefully consider Silver plans, as you’ll forfeit your CSR benefit if you don’t select a Silver plan.)

Texas has not expanded Medicaid under the ACA, so there is still a coverage gap in the state. An estimated 617,000 people are in the coverage gap in Texas, which means they earn less than the poverty level, are not eligible for Medicaid (due to lack of Medicaid expansion in Texas), and are also not eligible for subsidies in the Marketplace because their income is under the poverty level. 12

As a result of the Affordable Care Act, federal law only allows a self-employed married couple to purchase small group health insurance if there is at least one additional employee. Even if both spouses work for their business, they aren’t considered to be two separate employees (and thus eligible for group health coverage, which requires at least two employees) under federal law. But Texas law is different, and takes precedence in this case. In Texas, a small group insurer must issue coverage to any group of two or more employees, even if the group only has two employees who are married to each other. 13

So if you and your spouse are self-employed together, you can consider Texas small group plans as well as individual market plans. Marketplace subsidies are not available for small group plans, but you might find that there are factors that make the small group plans preferable (such as the provider network), especially if you’re not eligible for Marketplace subsidies due to your income.

The Texas individual/family Marketplace has 16 participating insurers that offer coverage for 2024, 14 although plan participation varies from one area to another.

In most Texas counties, at least three insurers are offering health plans on the exchange in 2024, although some counties in the north-central part of the state only have plans available from one insurer. But there are also numerous counties where five or more insurers offering Marketplace plans. 1

In the Texas individual/family health insurance market, insurance companies have proposed the following average rate changes for 2025, applicable to full-price (pre-subsidy) premiums, 15

Source: Texas Rate Review Submissions 15

* Ascension/US Health & Life notified policyholders in mid-2024 that the carrier would no longer offer coverage in the individual market after the end of 2024. 16 Policyholders can select new 2025 coverage during the open enrollment period that begins November 1, 2024.

** Per SERFF filing ATEM-134192158, Wellpoint is new to the Texas individual market for 2025.

Prior to the 2023 plan year, Texas did not have an effective rate review program, so the federal government reviewed insurers’ rate proposals in Texas. But that changed as of the 2023 plan year, and the Texas Department of Insurance now handles rate review for individual/family health plans. 17

For perspective, here’s an overview of how full-price (pre-subsidy) premiums have changed in the Texas individual/family market over the years:

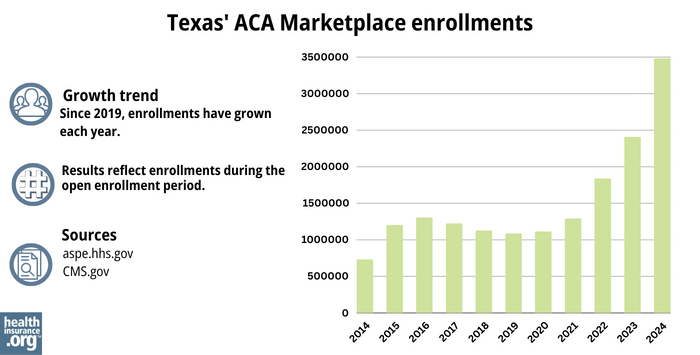

Enrollment spiked again in 2024 in the Texas Marketplace, for the third year in a row (see chart below). Nearly 3.5 million Texas residents enrolled during the open enrollment period for 2024 coverage. 28

The surge in enrollment during these years is likely due to the American Rescue Plan (ARP). Under the ARP, ACA’s premium subsidies are more significant and widely available. 29 The ARP’s subsidy enhancements have been extended through 2025 by the Inflation Reduction Act.

The 2024 enrollment spike was also likely driven by the “unwinding” of the COVID-related Medicaid continuous coverage rule that had been in place from 2020-2023. By April 2024, CMS reported that nearly 650,000 Texas residents had transitioned from Medicaid to a Marketplace plan at that point in the unwinding process. 30

Source: 2014, 31 2015, 32 2016, 33 2017, 34 2018, 35 2019, 36 2020, 37 2021, 38 2022, 39 2023, 40 2024 41

Texas Health Plan Compare (a service of the Texas Department of Insurance)

State Exchange Profile: Texas

The Henry J. Kaiser Family Foundation overview of Texas’ progress toward creating a state health insurance exchange.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.